Get a Personal Loan with Bad Credit

Are you experiencing temporary struggles with your personal finance? Is the next paycheck only in two weeks but you are short of cash now? Are there urgent expenses that need to be covered? Life is totally unpredictable, and it’s necessary to find quick and easy ways to resolve immediate disruptions and get back on track.Small personal loans are very popular as they help consumers avoid bigger problems by giving them a chance to fund their urgent needs and stay financially afloat until the next paycheck. If you think your monetary shortfall is awful, you are not alone and payday loans can assist you.

Here, at North’n’Loans, we deal with dozens of requests each day and aim to provide professional personal loan connecting assistance for every Canadian citizen.

It’s rather challenging to maintain a decent credit, especially when people take out different lending options due to the economic issues and other temporary monetary disruptions.

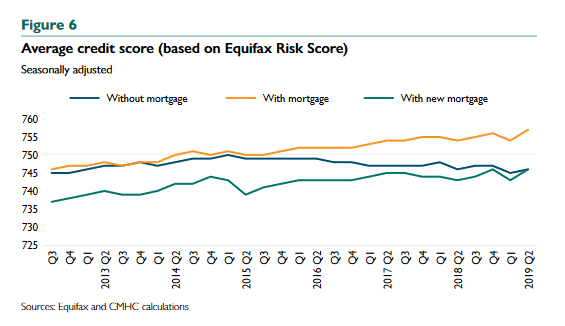

The latest Canadian Consumer Finance Association Report about consumer credit trends in 2019 has shown that the average credit ratings of Canadian consumers with a mortgage have increased while scores of consumers with other forms of credit have lowered slightly.

Types of Short Term Personal Loans Online

When you are strapped for cash and seek an instant solution, you have several options. You may use your own savings, tap your family and friends, or obtain private personal loans.

Let us guess the first two options didn’t work for you since you’ve come across this page in search of the best lending solution.

There is no need to panic or suggest this is your last hope. Although, applying for any type of loan should be a reasonable and responsible decision.

Financial experts advise to compare several options, review the offers from various lenders, and select the most suitable solution tailored to your current monetary needs. Don’t take out too much cash, as the debt must be paid back.

Generally, there are two types of online personal loans in Canada:

- Secured loans demand the borrower to provide some valuable collateral to the lender for the repayment term. It may be a house, an auto, or any other expensive and valuable item according to your agreement. This collateral serves as protection to the lenders, as they have the right to keep it in case of default or borrower’s bankruptcy. If you are looking for guaranteed approval you can opt for secured personal loans for bad credit at a bank. Keep in mind that this solution usually takes longer to process as the bank needs to take time and review your collateral before they issue the funds.

- Unsecured loans work best for consumers who have no time to waste on the tedious application process, or those who don’t have collateral to secure the loan. In this case, unsecured personal loans in Canada are faster and more convenient. Although, the lenders need to look at other factors to make certain you will be able to repay the debt on time as this solution is considered to be high-risk. Many people search for unsecured personal loans for bad credit with instant decision, but not every lender is willing to risk losing the funds without collateral. Thus, it pays to conduct your research or turn to North’n’Loans expert help and get matched with the most reliable direct lenders online.

How No Credit Check Personal Loans Work

While conventional lending institutions and banks require several weeks to process the request and review all the documents, online service providers value your time and work much faster.

Forget about having to go from one physical lending store to the other, search for the best pawnshops, or write down terms and rates of various lenders to compare them.

What can be better than sitting at your comfortable office desk or even on your sofa at home while scrolling down the smartphone screen and getting funded within minutes?

Well, private lenders in Canada for personal loans offer this great opportunity! Take advantage of modern technology and the digital era. All you need to do is use our website to submit your online application that won’t take more than 10 minutes. We just need to know your basic banking and personal data as well as the amount you want to connect you with our large network of direct lenders.

Please take into consideration the fact that almost every lender conducts at least a soft inquiry. This won’t damage the credit of the borrower but will just let the lenders know your credit history and previous payments. Thus, no credit check loans usually stand for small personal loans with a soft credit check. If you are a responsible borrower, there won’t be any issues and the funds will be deposited to your bank account upon approval.

Can I Qualify for Online Personal Loans?

Every consumer has different money needs and issues. Online lenders understand that and don’t have tough requirements for Canadian borrowers. To qualify, private lenders for personal loans ask you to:

- Be over 18 years old

- Have a Canadian citizenship/residency

- Live in the provinces listed on our website

- Have a steady employment

- Obtain income by direct deposit

- Have a monthly income of $800 or more

- Have a valid Canadian bank account open for over 3 months

- Provide an active address, phone number, and email.

Are Bad Credit Personal Loans Real?

While thousands of Canadians require urgent money aid, not every person can boast of having perfect credit. Can you qualify for bad credit personal loans in Canada with no credit check? Traditional banks and credit unions will most likely reject such applications, but we say “yes”.

North’n’Loans serves you and we are striving to protect the rights of each consumer and give them a chance to solve current issues. We all may make mistakes. Not every lender issues personal loans for people with bad credit, still take a chance applying through our website.

It would be much better if you improve the rating before you apply. This way the lenders will notice an improvement on your credit and offer better terms with lower rates. Otherwise, you will need to accept higher rates if you search for unsecured personal loans with bad credit.

Only Reliable Lenders Are Guaranteed

We can’t guarantee every request will receive approval from direct private lenders for personal loans as we don’t issue any lending decisions. However, we are always on your side and try our best to support you by matching your application with trusted lenders online. As a result, every borrower has more chances of getting approved. Although, it all depends on various factors.

Don’t hesitate to apply here! Forget about financial disruptions and urgent costs. Get rid of them fast and obtain the necessary funds today with the help of personal loans for people with bad credit! The choice is yours!

You Usually Ask & We Answer

How can I get a quick personal loan in Canada?

- You fill out the application form.

- Your loan request is transferred to our partner lenders.

- The direct lenders process your application, verify your identity and determine if you meet the requirements.

- You electronically sign the loan documents, if the lender terms are acceptable for you.

- You receive the funds within 2-3 business days.

Is it a good idea to get a loan?

Is it hard to get it?

- Active bank account in Canada

- The age of 18+

- Canadian residency

- Minimum credit history (12 months)

What is the best place to get a personal loan?

How long does it usually take to get approved?

What's the minimum credit score required?

Can you get a personal loan with a credit score of 550?

Do personal loans hurt credit?

What is the best reason to give when applying?

- emergency home repairs

- rent

- utilities

- medical expenses

- urgent car repair

- etc.