What is a debit card and why is it so popular? This is just another plastic card with some sensitive data that allows clients to withdraw cash from their accounts or purchase something. Often it is necessary to pay a fee for using this card. Do you want to know how to get a debit card? Once a person signs up for a new banking account from a local bank or a credit union, these financial institutions will also offer this card and connect it to a person’s account. Here are more useful details about its usage and the difference between debit card vs. a credit card.

Relevant Data and Security

Before a client obtains a new debit card from any finance-related service provider, these institutions need to give their clients the following details. They have to give a copy of the agreement between the cardholder and the provider, give contacts of people who may help solve any upcoming issues and tell about the cardholder’s responsibility to secure their card and protect PIN.

The debit card definition tells us about the necessity to utilize a PIN in order to protect the card from scams. PIN, or personal identification number, is a cardholder’s unique password that mustn’t be told to other people. It allows gaining access to sensitive data and conducting payments. Can you use a debit card online? Surely, you won’t need to submit your password for payments via a terminal.

It’s very important to select the best PIN that will protect the identity of the client from fraudulent activity and scammers. The finance-related service provider will give you a default PIN that should be changed as soon as possible so that nobody has the access or knows it. Experts advise not to use your date of birth, your phone number, address or Social Insurance Number in the form of PIN. Think of something unique that scammers won’t be able to find out.

Credit Card vs. Debit Card

If you want to spend more money in restaurants, use credit cards more than cash. If you want to spend less, use cash more than credit cards. But in general, we can think about how to use the pain of paying and how much of it do we want. And I think we have like a range. Credit cards have very little pain of paying, debit cards have a little bit more because you feel like today, at least it is coming out of your checking account, and cash has much more.

Dan Ariely

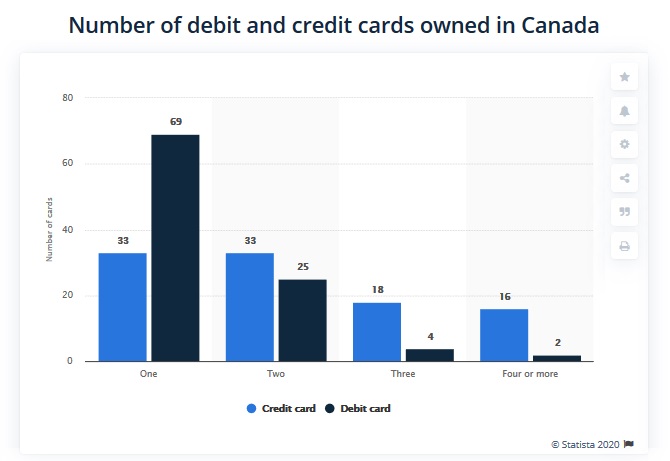

Statista.com shows that 69% of Canadians have one debit card. The survey mentions that this form of payment has become really widespread among people recently. More and more people utilize this payment method as it helps to keep track of their expenses and know where the funds go.

At first sight, ordinary consumers don’t see how these two pieces of plastic vary from one another. Both of them serve as cash substitutes and have similar features. Yet, they also differ a lot. Let’s get some insight into the main difference between credit and debit cards.

- Cash Flow. This is one of the top things that makes the two cards different. When a client uses a debit card to purchase something, the money is taken from the banking account. However, for credit card holders, the funds will be borrowed from financial companies, so providers of credit cards will offer you the funds in this case. Those who would like to increase their cash flow should opt for a credit card. If a person uses it responsibly and pays off the balance in full and in time, they will be provided a 21-day grace interest-free period.

- Price Protection. Not many people know the fact that certain credit cards come with price protection. They may help save the cardholder’s money after conducting purchases. For instance, if you’ve bought something with the credit card and its price goes down within a period of 60 days, the total difference can be given back to you. This is a helpful tool for the period when you know the prices will go down and you can get a refund later.

- Theft/Fraud Protection. The biggest concern of so many consumers across the world is fraud or theft. Such credit cards as Visa, MasterCard, and American Express offer fraud/theft protection to the cardholders. Those who have suffered from scammers or identity theft might get a full refund from these companies. On the other hand, using a debit card you can’t fully protect your banking account, so the thieves can get access to it and take your funds.

- Rewards. Another great benefit of credit cards is that they provide plenty of rewards and bonuses. Certain debit cards may offer 1% cashback on some payments, but credit cards usually offer more perks. Consumers have an opportunity to obtain various credit cards that will help them receive a cashback, win free trips, gift cards, discounts, etc. In case a cardholder repays the balance in full on a monthly basis, they will certainly receive more rewards from using a credit card.

- Boost The Credit Score. Are you experiencing difficulties with your credit score? Is it not good enough? Having a credit lending solution in your purse might improve this situation and help to boost your credit. The providers of credit cards send reports to the credit reporting bureaus, so being a serious user you have great chances of improving your score.

Here are the main facts on how to use a debit card as well as the main differences between the two lending options. Make your own choice and select the one that will work best for you and bring you more advantages.